Indian Retail Industry & The COVID Story | Chapter 1

India started its Retail journey a long time back. In the early retail era, there was a concept of Weekly HAAT/Bazaar, where both buyers and sellers used to gather in a big marketplace for trading. This Weekly HAAT/Bazaar was a great attraction for both Urban and Rural places, where people used to buy their daily groceries, spices, utensils, clothing, etc.

With the evolution of PDS (Public Distribution System) of Grains in India, the Ration stores started to open in different parts of India. Along with that, the government also commenced the Khadi & Village Industries Commission (KVIC) initiatives to support the rural retail and many indigenous franchise stores.

After 1980 the Indian economy started to open, resulting in a significant impact on the retail industry in terms of size and functionality. Bombay Dyeing and Raymond commenced their retail chain in the textile sector. Later, Titan launched retail showrooms in various parts of the country under the organized form of retailing.

Over time, retailing in India shifted from manufacturing to pure retailing. During the 90s, retail outlets, such as Music World and Planet M in Music, Foodworld in Food, and Crossword in Books, entered the market. Due to liberalization and globalization in the Indian economy in the early 90s, the purchasing power of consumers increased, which started a new era of modern retail. Shopping malls emerged in the metro cities and urban areas, which give the people a world-class customer experience under a single roof.

Eventually, Supermarkets and Hypermarkets began to rise with the improvements in the distribution channels, supply chain management, back-end operations, etc.

In the late 90s Indian brands like Pantaloons, Shoppers Stop, and Lifestyle began to set up their chain of outlets across the country. International brands also started to penetrate the Indian retail market McDonald’s, Nike, Adidas, UCB, were some of the names. Today the Indian retail industry is one of the fastest-growing industries in the world and the second-largest employer in the country. With a 9% growth in the retail market from 2016 to 2018, India secured 2nd rank in the A.T. Kearney’s 2019 Global Retail Development Index (GRDI).

2005 – 2010

- Entry in the Food and General Merchandise category.

- Existing players started to reposition themselves into the market.

- Substantial investment commitment by large Indian corporations.

1990 – 2005

- Pure-play retailers realized their potentiality in the market.

Pre 1990

- Manufacturers started to open their outlets.

The New Age Indian Retail Industry

Like other countries, the Retail industry in India also divided into Organized and Unorganized retailing. By definition, Organized Retailing refers to trade activities undertaken by licensed retailers, which means retailers who registered for sales tax, income tax, etc. and that include privately-owned retail business, corporate-backed hypermarkets, and retail chains. On the other hand, the unorganized sector refers to the traditional format of low cost retailing, which includes Kirana stores, Mom and Pop shops, grocery shops, cigarette shops, privately owned general stores, etc.

Speedy urbanization, increased purchasing power, adoption of digital techniques, and changing lifestyles are the few driving factors for the rapid growth of the Indian retail. According to the IBE/blog_images/F report, Indian retail is arising as one of the largest sectors in the economy, which contributes 10% to GDP and 8% of the country’s employment. Figure 2 represents a rising trend for Indian retail market size from 2016 to 2018. The graph also forecasts that in 2021 and 2026, the market size will be increase to US$1,200 billion and US$1,750 billion, respectively. As per Deloitte’s’ report, the Indian retail market is expecting to grow US$1.2 trillion by 2021. The growth majorly will be driven by the rise in the e-commerce market. The organized sector expected to increase to 22% – 25% in 2021, primarily due to the increasing internet penetration in the country and the growing involvement of international brands in the segment. According to the IBEF report, the Organized and E-commerce sector estimate to increase to 18% and 7% respectively in 2021 (Figure 3). Along with that, the share of traditional trade comprising local Kirana, and Mom and Pop stores will decline to 75% in 2021, due to shopping mode preference change by many shoppers.

The Pandemic Effects and It’s Side Effects on Indian Retail

A. Lockdown Story

With the worldwide outbreak of the COVID-19, the entire scenario gets changed. During early March, the COVID cases started to rise in India. To fight against the increasing numbers, the Government of India imposed a nationwide lockdown in late March’20, which continued till May’20. Except for essential foods, groceries, and medical products stores, all other sorts of stores (stand-alone or in a shopping mall) of apparel, electronics, hardware, mobiles, furniture, etc. were completely closed for almost two months for the lockdown, which severely affects the retail market. During that time, most of the non-food/food retailers report around 80%-100% drop in sales. Even retailers of essential products experienced a loss, as they were unable to sell non-essential products that could give them a high-profit margin.

At the early stage of the lockdown, the Retailers Association of India (RAI) conducted a survey among 768 food and non-food retailers across the country, where more than 95% of non-food retailers responded that they closed their outlets during the lockdown and barely gained any revenue during that time. As per the study, except for Food & Grocery and Sports Goods, Entertainment, and Books, all other categories experienced more than 50% of loss, during March-May’20 (Figure 4). The survey also reported that the lockdown massively affected the country across the geography, but amongst them, the west region of India experienced the worst hit (Figure 5). According to the Confederation of All India Traders (CAIT), due to the double effects of COVID and lockdown, within the last two weeks of March’20, the Indian retail sector has lost approximately ~US$30 billion. They also predict that within the next few months, 20% of Indian retailers will oblige to wind up their business.

During the lockdown, all the categories incurred an enormous loss. Amongst them, Beauty & Personal Care faced the maximum hit and Food & Grocery the least.

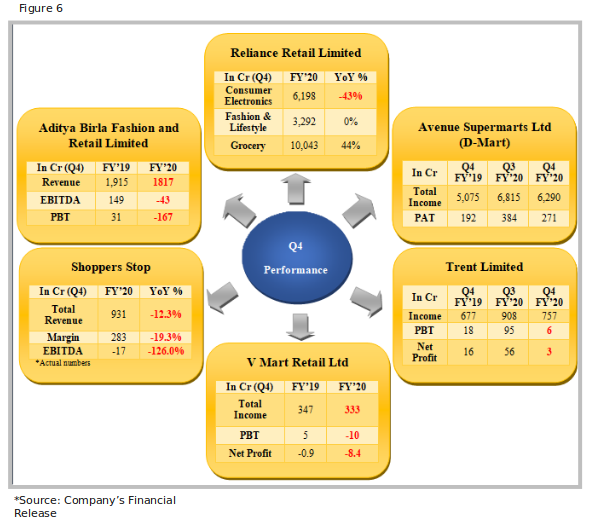

B. Impact on Q4 Performances of a Few Top Retail Companies in India

Avenue Supermarts Ltd (D-Mart) : According to the company’s Q4 and FY’20 report, the revenue for the entire quarter increased by 23%. However, only 11% of revenue growth was observed during March, due to the nationwide lockdown, from March 22nd. Also, the margins of the company were negatively affected, since, during the lockdown, government regulation didn’t permit the company to sell any Garments and General Merchandise products. Shoppers Stop: Due to the increase in COVID cases, the company shut all its 293 stores from mid of March. According to the company’s financial report for the full-year, the company’s revenue was Rs. 4,385 Cr, declining 1%, and EBITDA was Rs. 183 Cr, decreasing 31%, principally been affected by the Q4 COVID impact. Also, the company has written-off stocks of Rs.11.3 Cr.

Reliance Retail Limited: Due to the emergence of the COVID situation, the company shut all its stores, particularly malls, from March 14th, and all non-grocery shops and e-tailing from March 22nd. The closure of stores severely impacted the performance of the quarter. The disruption to importing devices from overseas, during the pandemic situation also affected the sale performance of the Electronic segment. However, during Q4, the EBITDA increased by 33%, majorly driven by growth in Grocery, more B2C sales, and higher productivity.

V Mart Retail Ltd : The store closure due to lockdown adversely affected the business, which led to a significant decline in revenues for the quarter. The Gross Margin and EBITDA also get hit drastically due to the lockdown, as a large part of the V Mart’s expenses are fixed costs.

Aditya Birla Fashion and Retail Limited: As per the company’s financial report, in early March, the COVID cases started to increase in the country, which resulted in a heightened sense of insecurity among customers, restriction in movements, and customers lost interest in buying nonessential goods. As a result, the footfall at all stores across the country drastically decreased, which caused a sharp decline in sales from the second week of March. Due to this unpredicted disruption, the company reported a loss in the Q4 ended March 31, 2020. Segment-wise, Pantaloons reported a 1% loss for the quarter along with Rs. 38 Cr losses in EBITDA and due to a drop in sales Lifestyle incurred a loss in EBITDA.

Trent Limited : The Company’s non-food business segment was adversely affected during the lockdown, due to no sales.

C. Acute Effects on Retail Job Market

Not just the revenue but also the employment of the retail industry negatively affected by the pandemic and the lockdown. After being closed for more than two months, the Retail Industry started to resume its operations from June 8th. Around ten weeks of these complete closures adversely strike the retail industry, which leads to salary cuts and layoffs. As per the founder of TRRAIN (Trust for Retailers and Retail Association of India), the non-essential segment, which includes Fashion, Lifestyle, Travel & Tourism, etc. will observe a large number of layoffs due to this lockdown. During June, Shopper Stop, the county’s one of the oldest departmental store chains, confirmed its plan to lay off around 1000 employees and shut some underperforming stores, as both pandemic and lockdown unfavorably hit their sales. However, as per one of the company’s spokesperson, the company will rehire the employees, once everything gets normal.

Along with big retailers, the Standalone shops also started to reduce their workforce, either by a layoff or forcing people to take leave without pay. The President of Clothing Manufacturing Association states that more than 80% of the garment industry, which also includes MSMEs, doesn’t have resources to pay salaries to their employees. According to a survey conducted by the Retailers Association of India (RAI), within 768 food and non-food retailers across the country, small retailers were expecting to lay off around 30% of its workforce in the future to sustain its business, the number is 12% for medium retailers, and 5% for large retailers.

C. Impact on Indian Consumers

Since the pandemic and national lockdown, the purchase preference and mode of buying of the Indian consumers shifted dramatically. Several changes majorly observed among the Indian consumers during lockdown and post lockdown situation,

More conscious and calculative on spending money: Along with the pandemic, people are facing job loss, salary cuts, and financial uncertainty, which pushes them to shift their spending from non-essential products to necessary and essential products. As per McKinsey and Company COVID-19 India Consumer Pulse Survey (06/19-06/22/2020), 75% of the population admitted that due to the current economy and personal finance condition, people are now very cautious about spending their money.

Inclination towards online shopping: With several mandatory precautionary measures, India began it’s unlock phase; maintaining social distancing is one of them. Most of the stores started to implement a queue system to maintain social distancing, due to which sometimes customers are facing long waiting times. To avoid waiting and the chances to get infected, many customers, especially in Big and Metro cities, are now buying online rather than going out to purchase. Nowadays, in urban areas, the buying volume pattern is changing; people are purchasing large pack size products to avoid frequent/short term purchases. However, in rural areas, people are still buying products from Grocery/Kirana stores and in small/sachet sizes.

More aware and conscious of hygiene: People are now more hygiene conscious than the pre-COVID era. They are ready to spend more on hygiene and sanitization products. Masks, Gloves, Sanitization spray, disinfector, etc. are at the top of the buying lists of every household. According to McKinsey and Company COVID – 19 India Consumer Pulse Survey (06/19-06/22/2020), Cleaning & Sanitization (39%), and Masks & Barriers (22%) are most important deciding factors, for the buyers, for choosing a shop to purchase. Another survey by the Retailers Association of India (RAI) stated that 75% of surveyed people preferring the stores which maintain a regular sanitization.

The New Normal in Retail Industry

Presently, the primary concerns for all the retailers are, how simultaneously they can run the business and take all precautionary measures as specified by the Indian government to ensure the safety of all the staff and customers. As per the SOPs notified by the government,

Staggering of work/business hours needs to follow in shops, markets, and malls.

Even for standalone/ small shops need to maintain the social distancing (6 ft distance/ 2 gaz ki doori), and not more than five persons at a time should be present within a Shop premise.

Maintaining the physical distance of a minimum of 6 Feet is important while queuing up at the entry of a shopping mall. Also, inside the shopping mall, maintaining social distance is required as much as feasible. To follow the physical distance norm, the number of customers inside all shops should be least.

Face Masks and Temperature checks for both staff and customers are mandatory.

Accordingto the guidelines of the Central Public Works Department (CPWD), the temperature setting for all the Air Conditions, and relative humidity, should be in the range of 24°C to 30 °C and 40% to 70% respectively.

For shops and shopping malls, all the frequently touched areas like doorknobs, elevators, escalators, buttons, handrails, shopping baskets, should be cleaned and disinfected regularly using 1% sodium hypochlorite.

Deep cleaning with Washrooms, along with disinfecting the washrooms fixtures on a regular interval, is mandatory.

In the Food Court, the seating capacity should not cross 50% of the full potential. Also, the authority needs to ensure the crowd and queue well managed in the area.

As per the SOP, there should be a proper crowd management procedure in place in the Parking lots and outside the Mall premises and preferable to present separate entries and exits for visitors, workers, and suppliers.

Hand Sanitization of staff and customers are necessary.

To maintain all these SOPs along with to secure the health of all the staff and customers, Retail companies started to take several initiatives.

Ideas to Adopt the New Normal

A new shopping Model: During the lockdown, Kirana stores and Mom and Pop shops performed an essential role. After the government declared a nationwide lockdown during March, local shops came in high demand. According to Metro Cash and Carry, a 40%-50% rise in business resulted from Kirana stores during the lockdown, where demand from the Restaurant and Hospitality sector dropped about 20%-30%. Jamshed K Daboo from Trent Hypermarkets, in a panel discussion, stated that ‘People are rediscovering mom and shop stores mainly because Kirana has been able to bring local flavors to the services offered with ease of delivery.’ He further added, ‘The future belongs to stores, which will follow a model that can be a bridge between a modern supermarket and a digital Kirana with an ease of delivery.’

Reliance already started an initiative by extending its partnership with the Kirana ecosystem. During the lockdown, JioMart gave uninterrupted services to Kiranas across many places in Maharashtra, which includes Navy Mumbai, Thane, and Kalyan, and witnessed an increased order flow of around 4X times than the pre-lockdown period.

According to the survey by EY, 1/5th of the Kirana store owners have started adopting online platforms to get a steady supply of goods and assistance in deliveries. Also, the pandemic and the lockdown created a trust for the local Kirana stores among the people. 79% and 50% of Kirana stores in Non-Metro and Metro respectively informed that many new customers are coming to their stores in the post lockdown period.

SMS: SMS represents Sanitize, Mask, and Social Distancing. Running a retail business or opening a store, is no longer only about earning profits, and satisfying customers. Now, the primary objective of all the retailers is safety for all the staff and customers. Apart from the SOPs provided by the government, retailers are trying to add many more processes for safe operation. Along with other retailers, Aditya Birla Fashion and Retail Limited, has taken various measures (Figure 9 & 10) while reopening their stores, Contactless billing and Pre-Booking slots to enter stores, are a few of them. To maintain all the in-store hygiene measures and seamless business operations together, Checklists are essential. A checklist is a platform that ensures that every staff and customer is following all the hygiene protocols within the store and it also helps to track each employee’s daily activities.

Digitalization: The COVID situation will stimulate more digital adoption in India, as, after the outbreak of the pandemic, the online shopping massively increased and small businesses started to digitize. According to a study by Morgan Stanley, 2020 will witness rising online intrusion in Food and Grocery and a few of the APPs to accelerate its motion. As per the prediction of some analysts, in a post-COVID world, the Indian online population can observe a sharp rise, online penetration in the F&G segment will be at the high, and the small and medium business enterprises adequately start using the digital platform.

Some of the retailers already started to strengthen their digital presence. To accelerate Reliance Retail’s Digital Commerce business on the JioMart platform using WhatsApp, and to assist small businesses on WhatsApp Reliance Retail and WhatsApp have entered into a commercial partnership agreement. Reliance aims to focus on 60 M micro, small and mid-sized businesses, along with the 30 M small merchants and almost millions of SMEs with the digital platform.

Aditya Birla Fashion and Retail Limited also focused on stimulating its digital transformation journey across several parts of the value chain. Shoppers Stop states in their Q4 report that, shortly, they will also initiate to strengthen its digital platform.

Conclusion

The pandemic has created a total upside-down impact on the retail industry. Several adverse circumstances have produced as a result of this pandemic, which severely impacts the industry in various ways. Many retailers right now are not concerns about the profitability of their business, as their existence, is at stake. On the other hand, many retailers are capitalizing the situation and trying different ways of operations and services in quest of new opportunities. Only time will tell whether this is just a time of anxiety and misery, or whether it is time to usher in a new era of Indian retail.